Demand was strong in the Middle East, China and Central Europe with a surge in Japan driven by the government’s GIGA 2.0 education initiative.

Apple sales were flat at 14.3 million units; Samsung’s sales were also flat at 6.9 million units, Lenovo led the growth with 23% increase shipping 3.7 million units.

Huawei followed in fourth place with 3.2 million units and 11.5% growth, while Xiaomi completed the top five, shipping 2.6 million units with 2.3% growth.

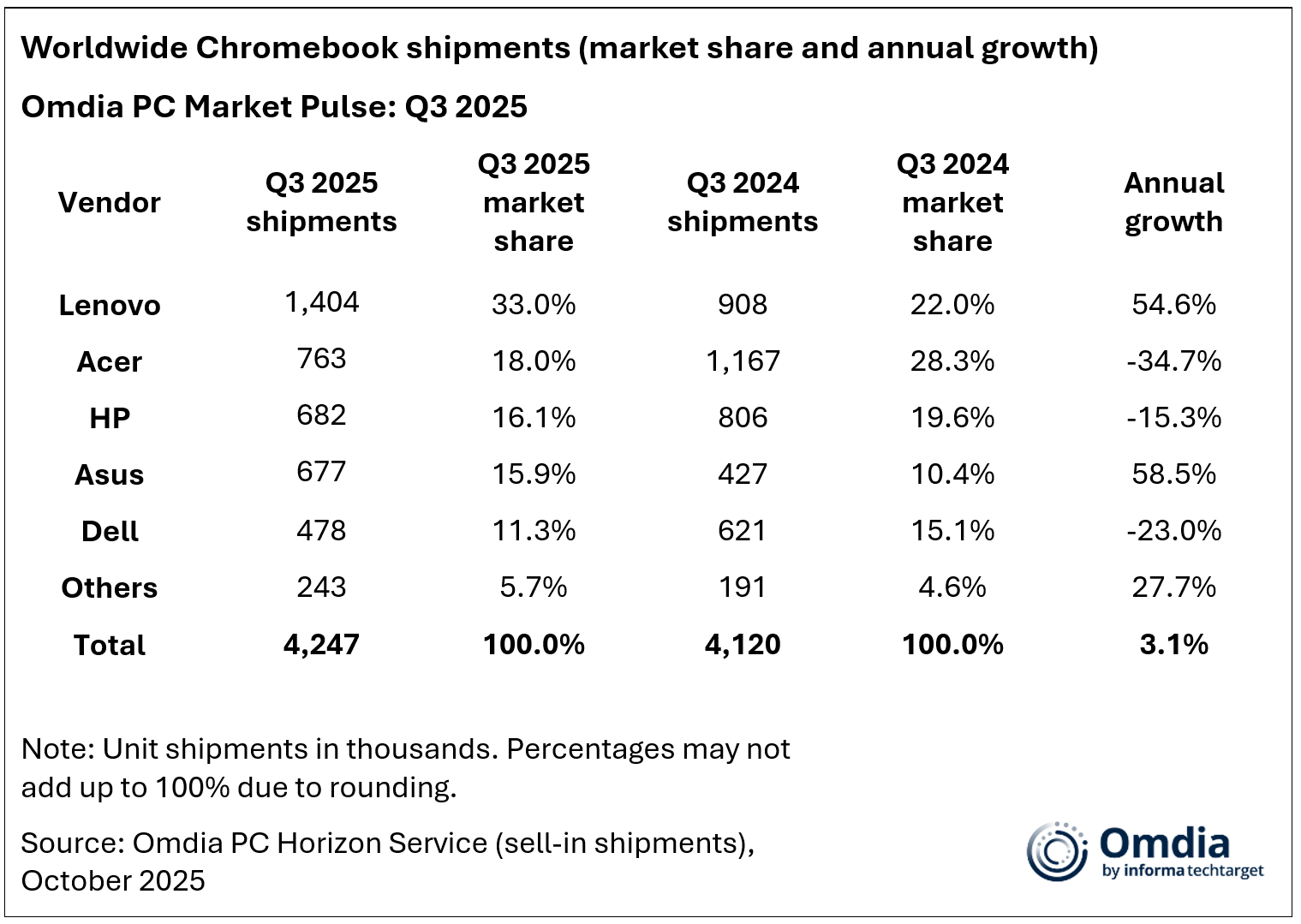

Chromebook shipments reached 4.2 million units, up 3% y-o-y, as renewed activity in education deployments gained momentum worldwide.

The Q3 Chromebook market grew by 3.1%. Lenovo led the segment, shipping 1.4 million units for 54.6% y-o-y growth.

Acer followed with an 18% market share and global shipments of 0.8 million units.

HP ranked third, shipping 0.7 million units and posting a 15.3% annual decline.

Asus, which also benefited from Japan’s GIGA 2.0 project, was fourth with 59% y-o-y growth, while Dell rounded out the top five