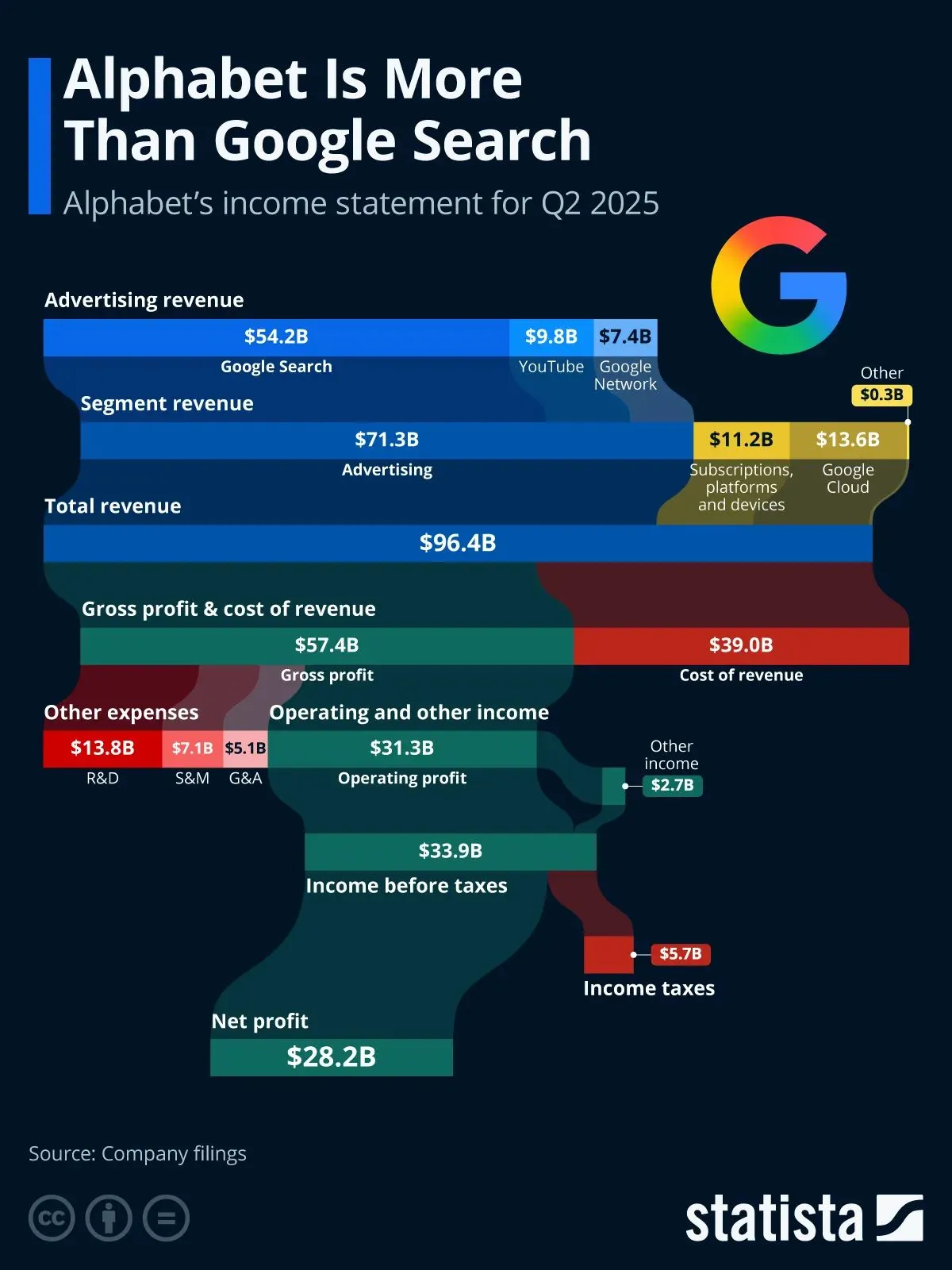

In Q2, Google Cloud had $13.6 billion revenue representing 14% of the company’s total revenue. That’s up more than 300% from $3 billion and less than 8% of total revenue five years ago.

Almost all of Alphabet’s other activities, including hardware (e.g. Pixel and Nest devices), app sales and subscriptions (e.g. YouTube TV, Music or Premium), accounted for 12 percent of Alphabet’s revenue in Q2 and while it doubled over the past five years, it’s not growing as quickly or as profitably as Google Cloud.

Finally, there’s Alphabet’s “Other Bets”, i.e. the company’s investments in new and emerging technologies.

These include companies such as Calico, CapitalG, GFiber, GV, Verily, Waymo and Wing. As the name suggests, these investments are bets on the future that don’t play a meaningful role in the present.

In Q2 2025, Other Bets accounted for just 0.3 percent of Alphabet’s revenue.

Alphabet is highly profitable. In Q2 the the company had a gross profit margin of 60% and an operating margin of 32%.

With net income of $28 billion, the company’s net profit margin was 29%, which is significantly higher than the industry average but slightly lower than that of fellow tech giants Microsoft (36%) and Meta (39%).