BEVs accounted for about 70% of these sales, but the PHEVs grew 47.8% y-o-y.

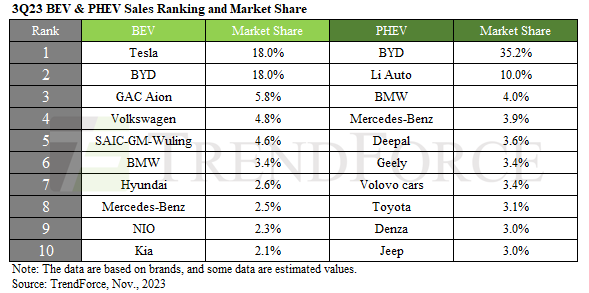

Q3 top brands were Tesla at No.1 followed closely by BYD. When sales of BYD group’s subsidiary brand Denza are included, BYD out-shipped Tesla.

GAC Aion, Volkswagen, and SAIC-GM-Wuling maintained their 3rd, 4th, and 5th positions in the third quarter.

NIO, returning to the list after a hiatus, ranked 9th but continues to grapple with significant losses and layoffs.

PHEVs, offering the convenience of two kinds of energy and resolving BEV charging challenges, continue to enjoy strong sales in China and the US, despite being excluded from the NEV category in some European countries.

BYD remains firmly in the lead in the PHEV market, actively expanding its brand and portfolio. In addition to Denza, the group also includes its luxury EV car brand Yangwang and the rugged, off-road-focused Fangchengbao.

Snagging second place (10%), Li Auto achieved its first quarterly sales milestone of over 100,000 units as it benefitted from rising demand for large SUVs in China.

BMW and Mercedes-Benz, though steady and growing, face the risk of being overtaken if they do not expand rapidly enough.

TrendForce forecasts 32% growth for EV sales in 2024, with total sales expected to reach 17 million units.

However, there are indications that the market is shifting, such as the delayed electrification of major American automakers, layoffs, and scaled-back investments in battery production